- The euro could sink even further after hitting dollar parity, a Citi strategist told CNBC on Tuesday.

- The shared currency is already trading at 20-year lows as Europe's energy crisis causes economic upheaval.

- "We're in a story of a fierce downside bias in the manufacturing cycle in Europe," Luis Costa said.

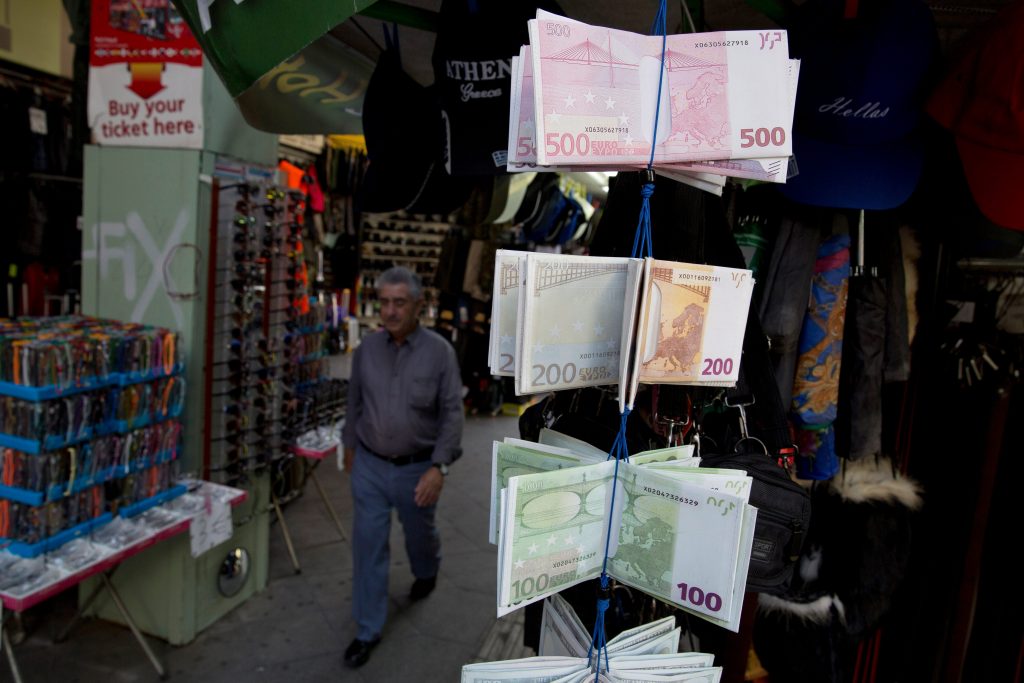

The euro is likely to fall further against the US dollar even after it lost parity and hit 20-year lows, according to a Citigroup strategist, who said Europe's energy crisis is behind the move.

Luis Costa said surging prices for natural gas and other commodities are having an outsized impact on European economies, which already face energy shortages in the fallout from the Ukraine war.

That means their shared currency is likely to keep weakening against the greenback, Citi's head of strategy for central and eastern Europe, the Middle East and Africa told CNBC's "Squawk Box Europe".

"Household economies in Europe are going through a much more violent shock, at least for now, than household economies in the US," he said Tuesday. "This is the story — that's what brought us below parity."

"Our outlook, trades and positioning are definitely biased towards further euro depreciation from where we are now," he added.

The euro fell below $1 on Monday for the second time this year, hitting $0.9968 as fears of a European gas shortage intensified and spurred worries about recession. It stayed near 20-year lows early Tuesday, when it touched $0.9902, but had risen to above parity at $1.0009 at last check.

The euro is grappling with a strong dollar and an energy crisis that's seen natural gas prices soar 300% this year and has left Europe facing an economic battle.

The currency's drop this week came after Russia's state-run energy company Gazprom said Friday it will close the Nord Stream 1 natural gas pipeline for maintenance for three days. That adds to the squeeze on energy supply to households and to industries needing power generation.

"It's about the exposure and the vulnerability in the European economy when it comes to the magnitude of the energy shock that we're getting in this bloc," Costa said, in attributing the euro's weakness to the energy crisis.

"We're in a story of a fierce downside bias in the manufacturing cycle in Europe," he added.

Fears that the energy crisis will plunge Europe into a recession have tied the European Central Bank's hands somewhat in raising interest rates to curb hot-running inflation. Rate hikes tend to strengthen a currency, because higher yields attract foreign investors seeking returns, which in turn boosts demand.

"It's becoming absolutely glaring that the ECB's room to lift rates will be minimal," Costa said.

Read more: The euro sinks below parity against the dollar as Gazprom pipeline shutdown stokes recession worries